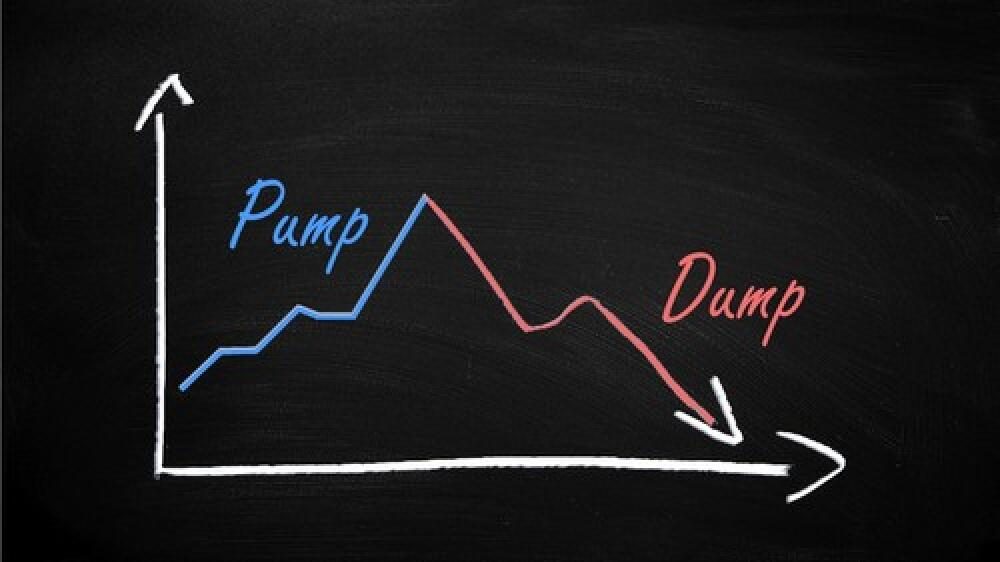

Forget complex code exploits; crypto’s biggest threat comes from 438 masterminds. A new study from University College London pegs this small group as responsible for the vast majority of pump-and-dump schemes, raking in $250 million annually by manipulating markets.

These masterminds orchestrate schemes that inflate crypto coin prices through hype, then sell off their holdings once enough buyers bite, leading to $3.2 trillion in artificial trading volume overall. Citing Google, the report highlights “cloaking” scams as particularly damaging within this landscape.

Telegram emerged as the go-to platform for these manipulations, with masterminds leveraging channels and chats to manufacture artificial demand. Researchers emphasize the simplicity of executing these scams should concern anyone investing in crypto coins.

To combat these schemes, the research team developed Perseus, a tool that analyzes and tracks the coordination behind the manipulations. This tool, with a real-time fetcher, a temporal attributed graph generator, and a mastermind detector aims to expose the key players and measure their impact.

Researchers suggest that technology like Perseus, complemented by broader regulatory measures, is crucial for identifying and mitigating these harmful schemes in the largely unregulated crypto space. According to the team, “At some point, some form of regulation is going to be needed to keep the system running.”